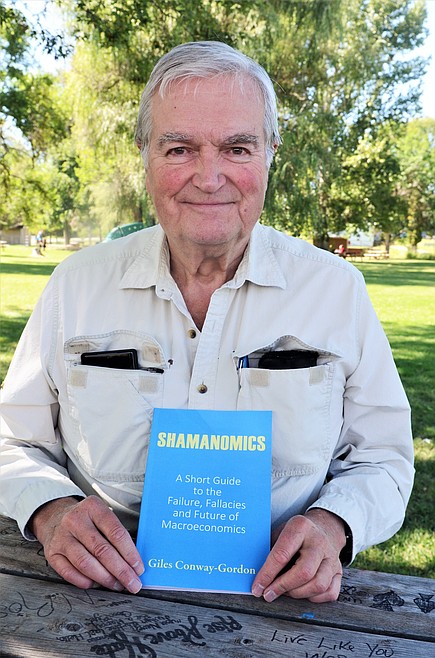

Ronan author makes case for long-ignored human side of economics

The financial crisis of 2008 exposed the failures and fallacies of prevailing economics theory and practice, according to retired investment banker Giles Conway-Gordon of Ronan. In his new book, “Shamanomics — A Short Guide to the Failure, Fallacies and Future of Macroeconomics,” Conway-Gordon explains in relatable, layperson language how the modern, mathematics-based practice of economics fails to be helpful in making policy by ignoring the decidedly un-mathematical, but critically important, nature of actual human beings.

The book was published by Colorado-based Outskirts Press in May and is available at online retailers including Barnes & Noble and Amazon.

Conway-Gordon studied philosophy, politics and economics at Oxford University in the early 1960s. Even then, as an undergraduate, he found the subject of economics “questionable in its methods,” he said recently. He felt the main text book, Paul Samuelson’s “Economics,” which remains a standard in most classrooms, does not relate to the real world or real human behavior and concerns. He maintains the field of economics has done nothing to progress since then.

Conway-Gordon compares the progress of economics theory over the past 100 years with a number of other human fields of endeavor.

“Flight progressed from Kitty Hawk to space flights; biology, engineering, any applied human endeavor, have seen colossal advances.”

The field of Economics, on the other hand, has shown no progress, he said.

“In fact, it’s gone backward. It has created catastrophe.”

“Macroeconomists like to think of themselves as grand theorists who are able to understand the world,” Conway-Gordon said. “But the track record economists have is disastrous.”

Conway-Gordon had a long career in investment banking and global asset management in major financial hubs of the U.S. and Europe.

“All the way along, when I was banking, you had to try and work out what on earth the economists were saying and what effect it might have on markets.”

“If macroeconomists have a use, it is to provide governments and central banks with reliable advice in the management of the national economy and the financial system,” Giles says in his book. “Given the importance of their role, economic advisers to governments have a particular responsibility to be competent … [I]f they are to be of any real use, socially or politically, they must be accurate in their analysis and reliable and successful in their advice.”

No one did what was required to head off the global financial crisis of 2008, considered the worst since 1929, although its imminence was in full, plain view, Conway-Gordon said. His book cites Andy Haldane, chief economist at the Bank of England, comparing the failure of economists to predict the 2008 crisis to the failure of the UK weather service failing to predict a devastating UK hurricane in 1987.

“Macroeconomists failed twice,” Conway-Gordon said. “First in not foreseeing and taking steps to prevent it, and secondly, in failing to cure its consequences,” i.e. the slowness of the recovery, and growing inequality.

“Far from being reliably useful, economists drove the global economy off a cliff in 2008,” he states in “Shamanomics.” And the monetary policies adopted as a result “have generated a sustained boom in the price of investment assets and real estate while economic stagnation has seen real wage levels fall. The consequence has been a marked increase in social inequality, and it is not difficult to see this as the major cause of the gathering social unrest in developed economies.”

“What have the economists done except to mess things up?” Conway-Gordon said. “Economics has no track record of good achievement to stand on, in fact the opposite.” He quotes several well-known economists at the beginning of each chapter of his book who admit as much.

His book neither spares nor favors advisors of any political party, claiming most fall into the same trap of attempting to mathematically describe and predict human behavior. He says economics should be considered more of a behavioral science, if a science at all, with all the inherent unpredictable nature of adapting to circumstances and human impulses that are constantly changing.

“The problem is that economics is essentially a messy business,” Conway-Gordon said. “You can’t reduce it to simplistic formulae and graphs, such as supply and demand curves, at any level; not at the level of you and me, and even more certainly not at the level of deflation, inflation, employment, growth — the much wider and important factors that economic advisors to politicians and government are supposed to be coming up with.” This is because “human behavior changes all the time. We change our views about things continuously. We adapt to our own points of view, but also to circumstances.”

Conway-Gordon said behavioral economics, which is combined with psychology to study and describe specific human reactions to certain circumstances, has been successful in advising certain government programs at the level of individual human judgment and decision-making.

“A couple of people have won Nobel Prizes for that contribution, which is valid,” he said. But at the macroeconomics level, predictions and management of economies from the traditional numerical “pseudo-scientific” stance have led to disastrous policy.

Such problems with the “science” of economics, Conway-Gordon said, are starting to be recognized more widely. The final chapter of his book discusses a “shift toward fully recognizing moral, social and other human concerns as necessary factors in macroeconomics.”

“They realize that all of this pseudo-decisiveness and mathematical opacity is really a load of nonsense, and they have to get back to how human beings really behave,” Conway-Gordon said. Concepts such as community, moral obligation, empathy, fairness and justice are universal and powerful human motives, and have been shown to be the real impulses of the way people behave and hold economies together even in very difficult circumstances, he said.

“It’s not going to result in grand theories like, ‘Well, if we raise interest rates half a percent then inflation will do such and such.’ But it’s going to be more sensible. It’s going to be the basis for a more humanly successful government.”

“As sober as it is provocative,” was the assessment given “Shamanomics” by the esteemed Kirkus Reviews. “A painstaking and thoughtful depiction of macroeconomists’ limitations and pretenses … In impressively accessible language, the author provides an analysis of both the industry’s forecasting mishaps as well as the technical reasons for its incompetence.”

For more information, or to contact the author, visit the book’s website, shamanomics.info, or his personal site at gilescogo.com.

Conway-Gordon will be signing copies of his new book at Barnes and Noble in Missoula soon.