Commissioners backpedal on controversial resolution

Lake County Commission Chair Gale Decker seemed a little wary as he stepped to the microphone for last Thursday’s public hearing.

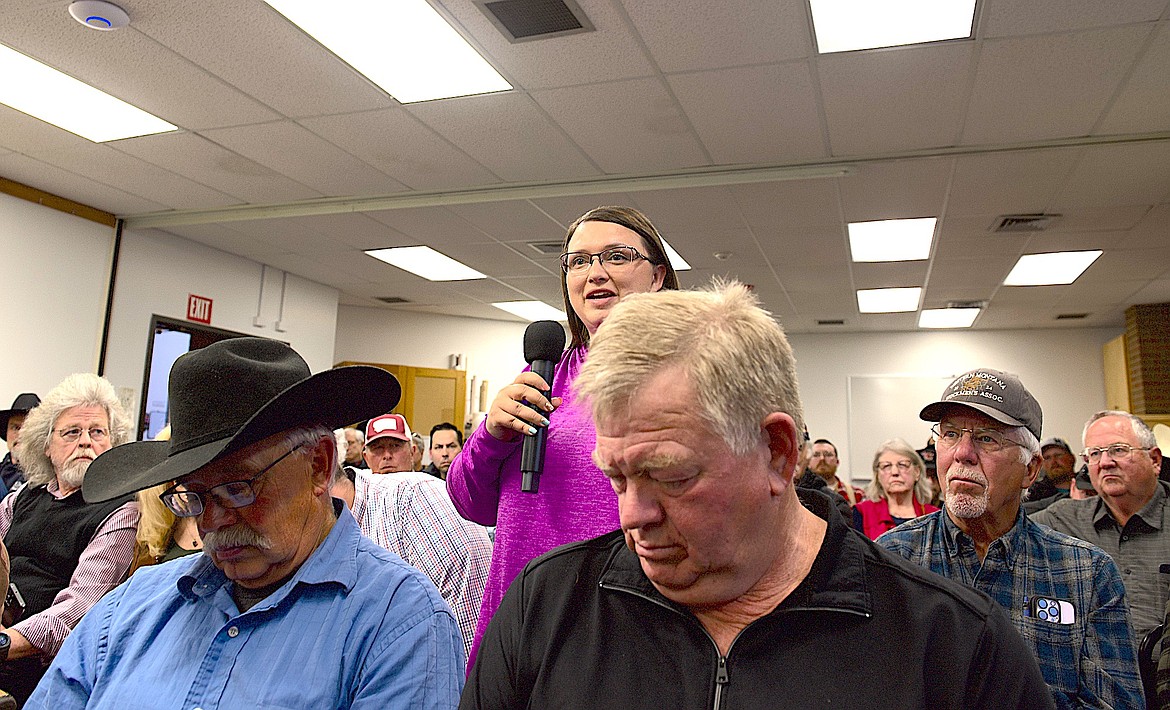

The topic, a resolution to impose a Notice of New Construction for any property improvements in Lake County, had already drawn ample ire on social media, and the commissioners were apt to attract more of the same from the crowd of at least 75 people filling the courthouse conference room, and another 20 or so tuning in via Zoom.

As originally written, the resolution would have imposed a filing fee of $5 for any new construction, including buildings, structures, fences, mobile homes and house trailers on an established foundation. If the fee wasn’t filed prior to construction, a penalty of $1,000 could be imposed after work on the development – however minor – began.

A revision would have established a value of $50,000 or more for improvements that needed to be reported, and excluded fencing, decks, doghouses and other minor projects from list. “What we're really after is big ticket items,” Decker said.

In his opening remarks, he explained that the proposed resolution was an effort on the county’s part to alert the Department of Revenue to new taxable development in the county so that property could be appraised accordingly. It evolved after an audit released last December revealed that the DOR, which is tasked with annual property appraisals, was missing an estimated $300 million annually in new construction value across Montana.

New construction is particularly crucial to local governments, since it brings fresh revenue to budgets capped by state law.

Decker, a former math teacher, told the crowd he had conducted his own experiment, using the 183 applications for sewer permits filed in 2023 with the Lake County Department of Environmental Health. He randomly picked 18, researched them to see if buildings had been constructed and if so, whether those improvements had been taxed in 2024-25. Of the 18, seven (or 38%) had eluded appraisals, which could statistically be applied to mean around 74 of 183 properties are still not on the tax rolls.

He noted after the meeting that it had taken him about an hour to figure that out, which reflected the question broached over and over again at the meeting: if the DOR receives that same information, and more – including building and electrical permits – why is so much new construction flying under their radar?

Commission Bill Barron pointed out that new legislation, Senate Bill 404, will require local governments and the Department of Labor and Industry to send copies of building and electrical permits for new construction to the DOR within 90 days after those documents are issued.

“So this is potentially the information we were trying to generate from a notice of new construction,” he said.

Under current state law, it’s not the property owner’s responsibility to report construction; it’s the job of the DOR’s regional appraisers to go find it. The resolution was an attempt to help them get the job done, Decker said.

He acknowledged that commissioners could take a less controversial route, and “say we're wadding this up and throwing it away … But, if we do that, I can guarantee you there's no property tax relief for you as far as new construction being added to the tax rolls.” And that results in higher taxes for those who “play by the rules.”

“I'm not trying to throw the Department of Revenue under the bus,” Decker added. “The governor and the legislature have given that department an impossible task.”

The audience seemed to agree that it wasn’t the county’s job to make the state’s work easier. “I'm getting the gist from the room that this is a state issue, not a county issue, so I urge you to kill this,” said one participant to applause.

Others, roiled up about the recent explosion in property taxes, said government should be looking elsewhere for revenue, and mentioned sales or tourism taxes as an option.

“If we want to buy a run-down piece of property and improve it, we should get a pat on the back and a bonus,” protested one man. “We're retired and we're on fixed incomes, and our property taxes just keep going through the roof. It's just crazy.”

At the close of the meeting, Commissioner Steve Stanley proposed a motion to rescind the resolution.

“That's the easy part,” he said. “The hard part is then I think we need to sit down with DOR, reimagine this issue, and see if there's a way we can give them information that will help their job go quicker and be more efficient, but we can't do anything without DOR.”

Barron seconded the motion, noting “the one thing I got from the vast majority of people I talked to is they didn't think this resolution was salvageable.”

He and Stanley both voted to rescind the resolution, with Decker casting the lone “nay” vote.